EN10025 Steel Market Price: Trends, Influences, and Outlook

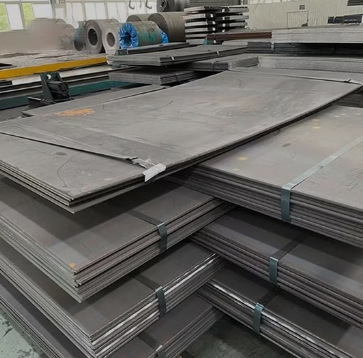

Introduction: Understanding EN10025 Steel

EN10025 steel market price is the European standard specification for hot-rolled structural steel products. It covers a range of grades including S235, S275, S355, S420, and S460, each defined by yield strength, tensile properties, chemical composition, and toughness. These steels are used widely in construction, infrastructure, heavy machinery, and general engineering.

Because EN10025 steels are essential in large-scale structural projects—bridges, buildings, industrial frameworks—their pricing reflects global and regional demand in the steel industry. When we talk about the EN10025 steel market price, we refer to the current per-ton or per-kilogram rate of structural steel meeting EN10025 specifications. However, this price fluctuates based on grade, size, processing, and market conditions.

Key Factors Affecting EN10025 Steel Prices

The EN10025 steel price is influenced by multiple variables, ranging from production costs to international trade policies. Some of the main factors include:

1. Grade and Mechanical Properties

Higher-strength grades such as S420 or S460 require additional alloying elements and tighter control during production, making them more expensive than common grades like S235 or S275. Toughness and impact resistance requirements also add to cost.

2. Thickness, Dimensions, and Form

Plate thickness and size significantly impact cost. Thicker plates require more raw material and energy for rolling, while thin or nonstandard sizes often increase production complexity, raising prices.

3. Raw Material and Energy Costs

The cost of iron ore, scrap, and alloying elements like manganese, chromium, or vanadium directly affects steel prices. Energy prices—electricity, gas, and fuel—are another key driver, as steelmaking is energy-intensive.

4. Freight, Logistics, and Import Costs

Transportation and shipping costs add substantial variations between regions. Importing EN10025 steel includes freight charges, port fees, customs duties, and insurance, which can raise prices by 10–30% depending on the distance and location.

5. Demand from Construction and Industry

When the construction and infrastructure sectors expand, demand for EN10025 steel rises sharply, pushing up prices. Conversely, during economic slowdowns or project delays, demand drops and prices soften.

6. Currency and Trade Policies

Exchange rate fluctuations, tariffs, and trade restrictions influence global steel pricing. Import-dependent countries are particularly sensitive to foreign currency depreciation, which raises local steel costs.

7. Inventory and Lead Time

Mills and traders often adjust prices based on available stock and lead times. When supply tightens or delivery delays occur, prices tend to rise.

8. Certification and Value-Added Processing

EN10025 steel supplied with full mill test certificates, third-party inspections, or additional processing such as cutting, bending, or coating generally costs more due to added labor and quality assurance.

Current EN10025 Steel Market Price Overview

Globally, the price of EN10025 steel typically ranges between USD 600 and USD 1,000 per metric ton, depending on grade and region. Lower-strength grades like S235JR and S275JR often trade near the lower end of that range, while higher-strength grades like S355, S420, and S460 can reach the upper end due to alloy content and testing requirements.

In Asian markets such as China, standard EN10025 S235JR plates of 14–20 mm thickness are commonly quoted around USD 600–650 per ton. Thicker plates above 70 mm or higher-grade variants like S355 may command prices between USD 700 and USD 900 per ton.

In European markets, prices tend to be slightly higher due to energy costs and labor expenses. Western European mills may quote EN10025 S355 plates at around USD 850–1,000 per ton, depending on order volume and lead time.

In the Middle East and South Asian regions, local price levels vary widely. In Pakistan, for example, domestic structural steel rates (converted from local currency) often exceed international averages due to energy costs, import duties, and logistical expenses. Retail steel prices there can reach the equivalent of USD 1,000–1,100 per ton when transportation and taxes are included.

Price Comparison and Key Considerations

When comparing EN10025 steel prices between suppliers, buyers should always verify:

-

Delivery Terms: Is the quote ex-works (factory), FOB (on board), or CIF (landed cost)?

-

Dimensions: Different thicknesses and widths change the per-ton cost.

-

Quality Requirements: Impact testing, ultrasonic testing, or specific certifications add cost.

-

Payment and Delivery Time: Shorter lead times or flexible payment terms may carry premiums.

-

Import Taxes and Duties: Tariffs can significantly affect landed cost, especially in countries with protective trade measures.

For accurate budgeting, prices should always be compared on a like-for-like basis using consistent terms.

Market Volatility and Risks

Steel prices are historically volatile, and EN10025 steel is no exception. Several factors contribute to frequent fluctuations:

-

Raw Material Instability: Prices of iron ore, coal, and scrap can swing sharply due to global demand changes.

-

Energy Market Shocks: Rising oil and electricity costs increase production expenses.

-

Freight and Logistics Disruptions: Shipping delays or fuel surcharges can temporarily inflate prices.

-

Trade Policy Changes: Sudden import restrictions or tariffs affect availability and costs.

-

Economic Cycles: Construction booms push prices up, while recessions reduce demand.

-

Speculative Activity: Traders may stockpile steel when they expect price increases, amplifying short-term spikes.

Because of these influences, EN10025 steel pricing must be monitored regularly, particularly for large projects where material cost forms a major share of total expenditure.

Market Outlook

Looking ahead, several trends will shape the EN10025 steel market:

-

Steady Global Demand: Infrastructure and renewable-energy projects worldwide will sustain structural steel consumption.

-

Sustainability Focus: Increasing emphasis on green steelmaking and recycled content may raise production costs but also stabilize long-term pricing.

-

Regional Imbalances: Asian mills are expected to maintain competitive prices, while European and Middle Eastern prices may stay higher due to energy and labor factors.

-

Currency Fluctuations: Exchange rate movements will continue to affect imported steel pricing.

-

Technological Advancements: Process automation and digital supply chains may gradually improve efficiency and cost transparency.

On balance, analysts expect EN10025 steel prices to remain within the USD 700–950 per-ton range over the near term, with moderate upward pressure if energy and raw-material costs increase.

Example Cost Calculation

Consider a buyer ordering 100 tons of EN10025 S355 steel plates, 20 mm thick, from an overseas supplier at a base price of USD 800 per ton. Adding shipping, import duties, and local logistics can significantly change the total cost:

-

Base steel: USD 800/ton

-

Freight and insurance: +USD 100 → USD 900

-

Import duties and taxes (15%): +USD 135 → USD 1,035

-

Inland transportation: +USD 30 → USD 1,065/ton delivered

This example shows how logistics and tariffs can raise the final delivered price by over 30% from the base mill quote.

Practical Strategies for Buyers

-

Monitor Market Trends: Track raw material, scrap, and energy price movements.

-

Lock in Prices Early: Use fixed-price contracts during volatile periods.

-

Order in Bulk: Large orders often secure discounts and better delivery terms.

-

Diversify Suppliers: Sourcing from multiple regions reduces dependency and risk.

-

Negotiate Logistics: Optimize freight and handling costs for better landed pricing.

-

Optimize Material Selection: Choose grades and thicknesses that meet design needs without unnecessary over-specification.

-

Stay Updated on Regulations: Keep informed about local tariffs and import/export rules that can affect cost.

Conclusion

The EN10025 steel market price represents a dynamic balance of raw material costs, manufacturing efficiency, global demand, and trade conditions. Though prices typically range between USD 600 and USD 1,000 per metric ton, actual rates depend on grade, thickness, and location.

In the current environment, structural steel remains in consistent demand due to global infrastructure and industrial projects. However, price volatility is likely to continue in the short term due to raw-material fluctuations and energy-cost pressures. Buyers and engineers should, therefore, approach procurement strategically—analyzing total landed cost, optimizing specifications, and securing reliable supply contracts.

Understanding these factors will help project managers, traders, and manufacturers make better decisions and anticipate market shifts, ensuring cost-effective sourcing and stable project execution.